The challenge:

Retailers store significant volumes of consumer information and payment data across a growing number of locations and devices. This trend is set to continue as shoppers’ buying habits move increasingly online.

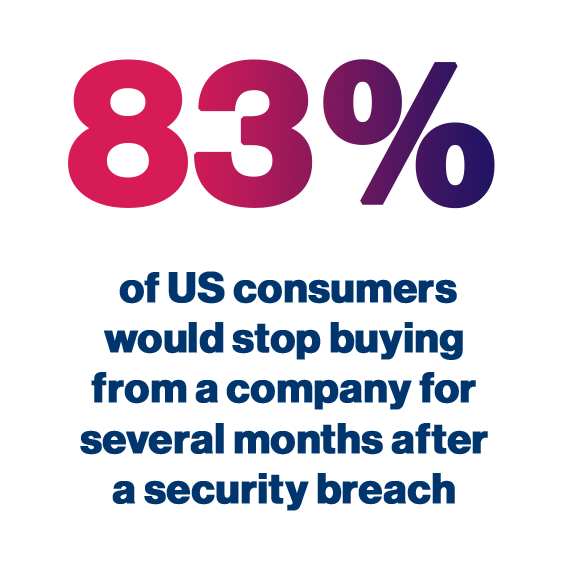

Several of the world’s most high-profile data breaches have involved retailers — and these breaches carry heavy consequences. Consumer loyalty is a critical element of success in retail. A KPMG survey found that nearly 20 percent of consumers would completely stop shopping at a retailer after a breach, and a third said they would take an extended break.

The latest version of the Payment Card Industry Data Security Standard, PCI DSS v4.0, further increases the demands on retailers and eCommerce businesses for enhanced cybersecurity, aiming to prevent theft of prepay, debit and credit card information.

Under local and cross-border data protection laws and regulation, retailers are also responsible for the security and privacy of consumer data, collected to fulfil online orders and as part of loyalty schemes, further adding to the complexity of data management.

Trusted across multiple industries, including the world’s top retailers, spanning 85 countries

Discover over 300 predefined and variant types of data, including personal and sensitive information from over nine major credit card brands

Streamline compliance with PCI DSS, as well as local and cross-border privacy legislation and regulation including GDPR, CCPA, APA and PDPA

Thousands of companies trust us to discover their sensitive data, including Canadian Tire, Vodafone and 1-800-Flowers

The solution:

Enterprise Recon delivers advanced discovery, management and remediation capabilities for all critical data across on-prem and cloud environments, streamlining compliance with PCI DSS and global privacy legislation.

Card Recon offers a simplified approach to scoping and data management for PCI DSS compliance, purpose-built for small and medium-sized businesses.

Retailers and eCommerce providers achieve compliance

with Ground Labs

A guide to PCI DSS compliance for merchants

This article is a merchant’s guide to PCI DSS V4.0, what's new and how data discovery supports sustainable compliance.

Data discovery and PCI DSS v4.0

This e-book explains how data discovery supports PCI DSS compliance efforts, whether you’re a merchant, service provider or assessor. From initial scoping to incident response, data discovery scanning for PCI DSS offers the situational awareness of account data necessary to support compliance over time.